Fiscal Client Resources

Jump to: General Fiscal Resources • FAQs

Financial Account Forms

These forms specifically relate to the Fiscal Client’s financial account with P&TC. It includes forms for obtaining and depositing money as well as setting up online donations.

Expenditure Request

Utilize this form to request a check to be issued for reimbursement or payment of an invoice with funds from your group’s fiscal account.

Preferred Method:

Online FormCheck Donations

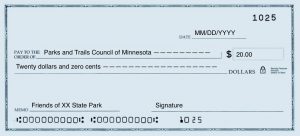

Check donations to your group must be made out to “Parks & Trails Council of MN” with your friends group’s name in the memo. Look at the check example for how this should look.

Checks that are over 90 days old will not be accepted. Checks from a previous calendar year will not be accepted after January 15.

Online Donations

If your group would like to be able to accept online credit card donations, fill out and submit this form. Once approved, a page will be created for your group with a unique URL that you can use to direct people to donate.

Preferred Method:

Online FormOther Options:

PDFThank You Letter Template

It is important to thank your donors! It is also important to make sure the needed information is included in that letter, including stating the following:

- your group’s affiliation with P&TC

- that no goods or services were received in exchange for the donation

- the tax ID number for P&TC

Download this template and customize for your group.

Applying for Grants

One benefit of the fiscal sponsorship program is that fiscal clients are able to seek grants that are available to 501c3 nonprofit organizations. In order to do that, fiscal clients need to follow P&TC procedures, including this checklist. Please reach out to fiscal@parksandtrails.org with any questions or concerns.

Prospecting

- Identify project and find grant opportunity that matches project/mission. (You are encouraged to pursue grants that support your group’s mission as a whole, rather than a specific project.)

Application

- Fill out P&TC’s grant form to obtain permission to apply for grant.

- Wait to receive permission to apply or notification of any conflicts from P&TC.

- Clearly identify P&TC as your fiscal sponsor on the grant application.

- Submit the application to the granting organization and share it with P&TC.

Notification/Award

- Share award decision/letter with P&TC.

- Share grant contract and/or other pertinent documents with P&TC.

- Ensure grant dollars are deposited directly into fiscal client’s account held by P&TC.

Implementation

- Implement project, keeping P&TC in the loop with progress and any major concerns in your group’s ability to carry out the project.

- Ensure expenditures associated with grant are indicated as so on the expenditure request form.

- Keep records of expenditures associated with the grant.

Reporting/Closing Out

- Submit any required reports to the grantor and share reports with P&TC.

- Notify P&TC when the project is complete and the grant is closed out.

General Fiscal Client Items

These forms and resources ensure fiscal clients and Parks & Trails Council are on the same page about expectations and inform P&TC of any changes.

New President and Treasurer Onboarding

When your group gets a new President or Treasurer, they are taking on the responsibility to oversee financial transactions for your group. Additionally, they are the main contacts that interact with P&TC.

To ensure the new President or Treasurer understands all of the responsibilities of the fiscal client and how to carry out financial processes, P&TC has an onboarding checklist to share all the needed information.

- Notify P&TC of the new President or Treasurer

- Read the Fiscal Sponsorship Basics and Fiscal Sponsorship Agreement documents (will be mailed)

- Watch the fiscal sponsorship video

- Peruse this fiscal client resources web page, including FAQs

- Have an onboarding phone call with P&TC

- Complete your first deposit & expenditure

Reach out to fiscal@parksandtrails.org with any questions or if your group has a new President or Treasurer.

Fiscal Sponsorship Agreement Video

This 17-minute video elaborates upon the agreement, detailing out in clear terms what the agreement means. In 2024, we’re asking all primary and secondary representatives (usually the president and treasurer) to watch before they sign the updated version of the agreement. This video is also helpful for any new presidents or treasurers that have just joined their group.

Fiscal Client Manual

All incoming primary and secondary contacts should be sure to read the manual before engaging in fiscal client activities such as submitting expenditure requests or engaging in fundraising activities.

FAQs

If your question is not listed here, please reach out to P&TC at fiscal@parksandtrails.org or 651-726-2457.

Can we use P&TC’s federal tax id number?

Only with permission from Parks & Trails Council. This may be for making tax-free purchases or for applying for a grant. Please email fiscal@parksandtrails.org to discuss.

Should our group get a Minnesota Tax ID number?

Visit the MN Department of Revenue website for more information.

Who should our donors make checks payable to?

Checks should be made payable to “Parks & Trails Council of Minnesota.” Donors should put your group’s name in the memo line. See example below.

What if someone accidentally wrote out the check to our friends group and not “Parks & Trails Council of Minnesota?”

Have the treasurer call P&TC.

Can our donors mail checks directly to P&TC?

Ideally, fiscal clients should collect checks from donors and mail them to P&TC in batches with the accompanying deposit form, which indicates the source of donations.

Can our group accept credit card donations?

Yes, through the P&TC website. Online donations are only considered tax-deductible if collected through your group’s donation page on P&TC’s website. Apply for your page.

How does P&TC issue payment?

By check.

How long does it take for payments to be processed and mailed?

Up to 10 business days from date request was received. Possibly more if the second authorization for an expenditure request is delayed.

Can we get petty cash from our fiscal account?

No. Payments from fiscal funds must be for costs already incurred. A receipt or an invoice must accompany an expenditure request.

Can I transfer funds to my group’s local checking account?

No. Payments from fiscal funds must be for costs already incurred. A receipt or an invoice must accompany an expenditure request.

Why do we need two people to authorize expenditures from the account?

This process sets an expectation that expenditures are agreed upon by the group, ensuring that one person is not the sole decision-maker.

What if one of the main authorizers needs to be reimbursed?

If one of the main authorizers is due to receive a reimbursement, two other authorizers need to approve that expenditure. An authorizer cannot approve a reimbursement to themselves.

Can we make tax exempt purchases?

Maybe. Only certain types of purchases and only purchases that can be invoiced may be eligible. Reach out to P&TC to learn how to make tax exempt purchases.

What should my group keep records on?

Everything! Such as:

- Donor names and contact information

- Donation amounts and date received

- Membership information

- Expenses (amount and purpose)

- Revenue (amount and source)

- Group information (bylaws, articles of incorporation, mission statement, etc.)

- Lots more!

What does P&TC keep records on?

Financial account information, including:

- Revenue (amount and source)

- Expenses (authorization, amount, and purpose)

Group information, including:

- Bylaws and/or articles of incorporation

- Board/leadership roster

If P&TC tracks all of this information, why do we need to?

P&TC manages accounting records from the perspective of P&TC. P&TC does not record information in the level of detail that friends groups often need.

Does P&TC send receipts to donors?

No. Sending receipts and thank yous to donors is the responsibility of the fiscal client. Your group is required to acknowledge your relationship with P&TC in the letter. Find a template letter here.

How do we access our account balance?

Talk to your treasurer first. Then, if you don’t have the most recent general ledger/statement, email fiscal@parksandtrails.org to ask for the balance. Please allow 1-2 business days for response time.

Our group wants to apply for a grant, what do we do?

The whole process is laid out here as a checklist.

Why do we need to obtain permission from P&TC to apply for grants?

Many grants are only available to 501c3 nonprofit organizations. As a fiscal client of Parks & Trails Council, you may be eligible to apply for those grants by using P&TC’s federal tax id. However, because P&TC and/or other fiscal clients may be considering applying for the same grant, we need to make sure to follow the rules set out by the grantor and any applicable laws.

What are restricted grants?

Restricted grants are dedicated to a particular purpose or project, as designated by the granting organization. They are permanently restricted for that purpose and cannot be used for any other expenses. Read more here.

Should my group seek restricted grants?

Because restricted grants can come with complex obligations, we recommend that you contact the Friends Group Program Manager before submitting your application. Read more about restricted funds.

How do we know which grants we are eligible for?

Each grantor has its own requirements for who is eligible to receive their funds. Check out the grant guide, peruse grantor websites, and reach out directly to grantors for more information.